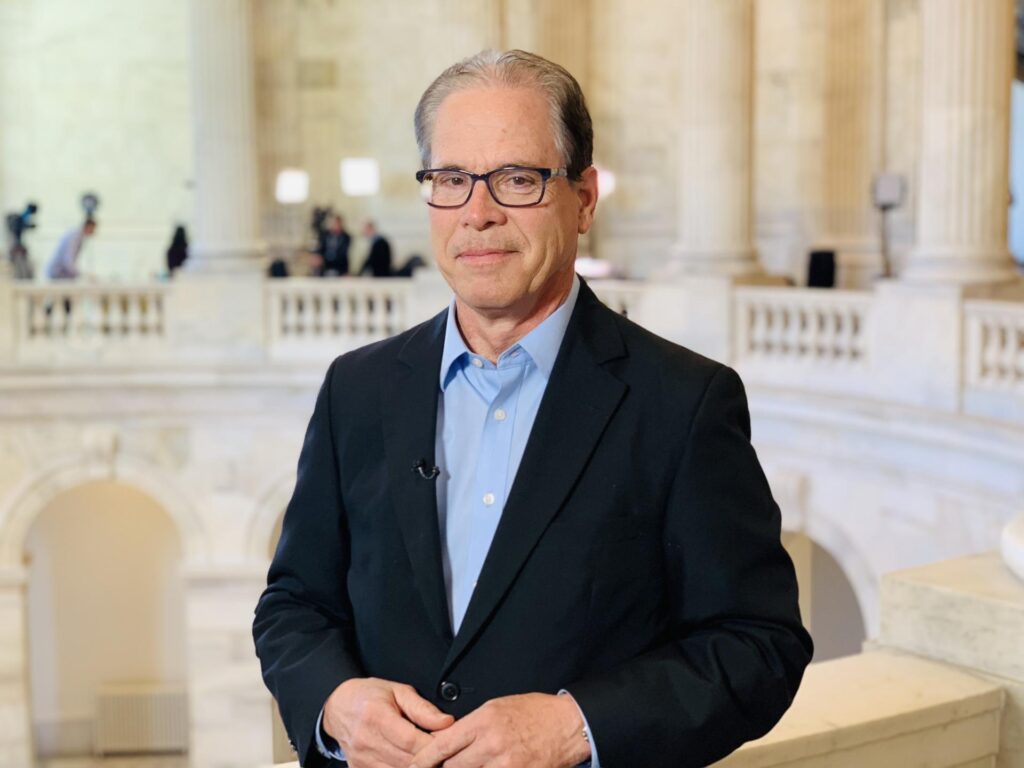

Sen. Braun Leads Bipartisan Challenge to Biden Rule Politicizing Americans’ 401(k)s

Senator Mike Braun and 49 Senators will be introducing their bipartisan challenge to President Biden’s ESG rule which politicizes millions of Americans’ retirement investments to favor Biden’s ideological preferences rather than getting the best returns for Americans.

The Senators joining Senator Braun include every Republican Senator: Senate Republican Leader Mitch McConnell and Senators Thune, Barrasso, Blackburn, Boozman, Budd, Britt, Cassidy, Capito, Collins, Cornyn, Cotton, Cramer, Crapo, Cruz, Daines, Ernst, Fischer, Graham, Grassley, Hagerty, Hawley, Hoeven, Hyde-Smith, Johnson, Kennedy, Lankford, Lee, Lummis, Marshall, Moran, Mullin, Murkowski, Paul, Ricketts, Risch, Romney, Rubio, Rounds, Schmitt, Rick Scott, Tim Scott, Sullivan, Tillis, Tuberville, Vance, Wicker, Young. Senator Joe Manchin joins on the Democratic side.

Representative Andy Barr is leading the House version of the legislation.

In November, President Biden instituted a rule that explicitly permits ERISA retirement plan fiduciaries to consider environmental, social, and corporate governance (ESG) factors when selecting investments and exercising shareholder rights.

This Biden rule replaces a previous rule which mandated fiduciary decisions be made solely on getting the best returns for the 152 million American workers that depend upon ERISA for their retirement. Because ERISA covers most employer-sponsored retirement plans, that encompasses close to $11.7 trillion in assets.

Under Biden’s rule, retirement fund managers can prioritize ESG factors instead of financial returns in their investment decisions for workers’ hard-earned savings. Plan participants could unknowingly be enrolled in ESG funds, which may not align with their political views.

In the most recent survey, most Americans think it’s a bad idea for companies to use their financial influence to advance a political or social agenda, as is the case in ESG investing.

A number of studies have shown that ESG investing policies have worse rates of return. For example, a study by UCLA and NYU found that over the past five years ESG funds underperformed the broader market, averaging a 6.3% return compared to 8.9% return respectively.

Additionally in comparison to other investment plans, ESG investors generally end up paying higher costs for worse performance.

This disapproval resolution will receive a vote on the Senate and House floor. Under House and Senate rules, Senator Braun and Representative Barr will be able to force a vote on this resolution to nullify the rule.

Additionally, the resolution only requires a simple majority vote threshold to pass and be sent to the President.

Senator Mike Braun previously led a challenge to President Biden’s vaccine mandate for private businesses, which passed the Senate on a bipartisan vote. When the U.S. Supreme Court struck down Biden’s mandate for being unconstitutional, the majority decision cited Senator Braun’s challenge under the Congressional Review Act as a significant reason for their decision.