Lawmakers Weigh In On Next Budget Session

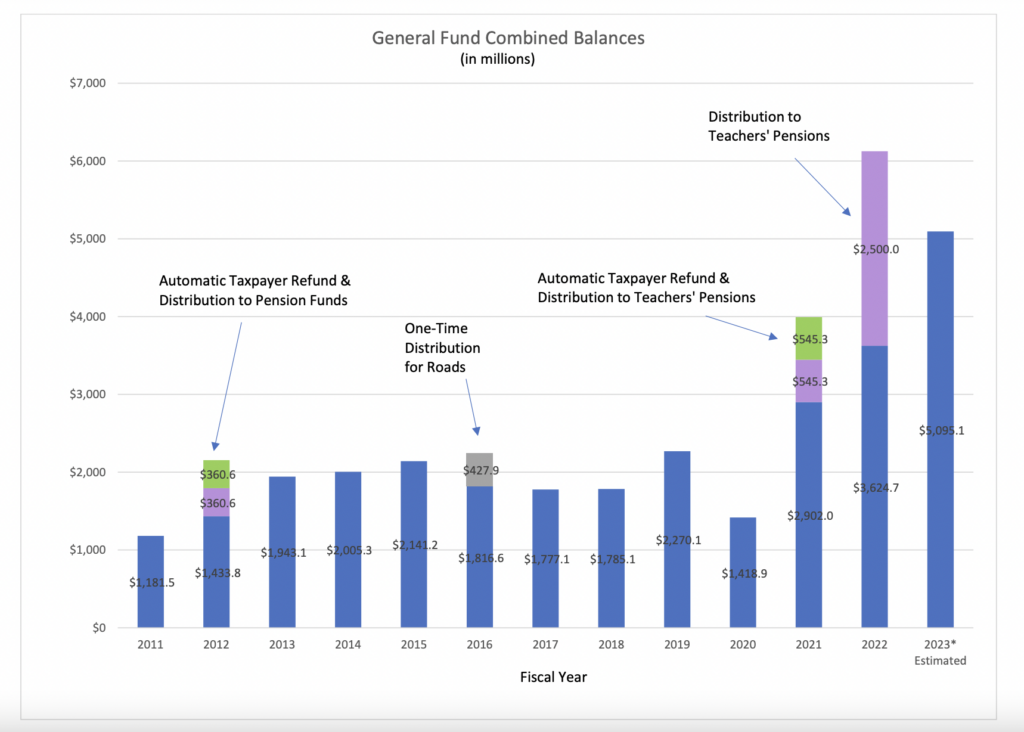

A graph showing the combined reserve balances lawmakers will contend with in the upcoming budget-writing year.

By Whitney Downard

Democrats and Republicans on a recent budget panel showcased different approaches to Indiana’s next two-year spending plan — from saving and paying down debt to one-time vs. ongoing investments.

Indiana’s revenues continue to outperform projections, bolstering swollen coffers as stakeholders prepare to draft the 2023 budget amid ongoing inflation and economic concerns. The state’s savings account held over $6 billion earlier this year before a summer special session sent $1 billion to Hoosiers for an automatic taxpayer refund.

Indiana writes its two-year budgets in odd-numbered years during four-month sessions, with the next scheduled to begin in January. Republicans, who hold the supermajority, seemed intent on keeping excess spending low, even with such high reserves, while Democrats urged investing during a panel discussion last week before the Governmental Affairs Society of Indiana.

For Sen. Fady Qaddoura, D-Indianapolis, Indiana’s consistent rankings in the bottom ten for K12 investment, infant and maternal mortality, and public health spending reflect badly on the state’s future. The majority of counties don’t have affordable healthcare, many struggle with a housing shortage and one-third of counties have maternal healthcare shortages.

“I think with $6 billion, we can probably make strategic investments,” Qaddoura said.

Fiscal restraint

But Sen. Aaron Freeman, R-Indianapolis, voiced concerns about how easily those reserves could zero out in an economic downturn. Throughout the pandemic, Republicans have credited the state’s savings for keeping Indiana afloat.

“When you look at the $429 million in Medicaid reserves, $644 million in tuition reserve accounts, $543 million in the rainy day fund, I don’t think those numbers are astronomically high. I don’t think they’re high enough, frankly,” Freeman said.

Freeman said he believed the budget surplus will hover closer to $4.5 billion after the distribution of the automatic taxpayer refund. Even with that price tag, Freeman said the biggest budget challenge in 2023 will be restraint.

Rep. Greg Porter, D-Indianapolis, said he saw the problem as needing to identify where to spend the money, naming K12 spending as one of his priorities. He credited previous infusions, including 2021’s education increase, to President Joe Biden’s American Rescue Plan.

Even that influx of federal monies didn’t make up for prior cuts to education funding, he said.

“We have too much money. We will have a $6.3 billion surplus. I think the challenge is, ‘What are we going to do with those dollars?’,” Porter said. “We can’t fund it on the cheap… (and) we’re still playing catch-up.”

Rep. Mike Karickhoff, R-Kokomo, said those major investments, especially in K-12 education, were because of his caucus’ dedication to paying off debt early. The state’s biggest outstanding debt obligation, a pre-1996 teacher pension fund, is scheduled to be paid off by 2030, freeing up $1 billion per budget cycle.

“(If) we get that paid off early, that’s going to free up more money for us to do the things we need to do,” Karickhoff said. “It’s easy to say, ‘Well, we have $4 billion or $6 billion in reserves …’ That’s a number that can change very quickly … We want to invest in human capital in ways that (are) strategic, that help empower people to help themselves and address some of the concerns that my colleagues are talking about.”

But Qaddoura noted that teacher shortage persisted despite the spending, highlighting classrooms without teachers at the school his children attend. When reserves make up 28% of the budget, he said, it hurts Hoosiers.

“I firmly believe that the most powerful tool on earth that sustains businesses, that sustains the economy, that is a smart investment, that is not stuffing cash in a mattress and saying that’s fiscally responsible, is education,” Qaddoura said. “I think that businesses are desperately in need of workforce. Indiana has a good business environment (and) friendly tax system but we do not invest in our workforce.”

Reserve level

By the end of the 2023 fiscal year, even with spending on the automatic taxpayer refund and social services, Qaddoura said reserves would sit at 25%, double the state’s own goal of 10-12%.

Karickhoff hedged, saying that while inflation had boosted reserves it would also increase agency costs. Capital investment projects funded in the last budget cycle have already encountered hurdles, with construction costs ballooning.

“We’re going to see our budget grow pretty substantially and it’s going to be a budget that grows just to take care of the fundamentals,” Karickhoff said.

He added that the caucus would prefer to use the money for one-time expenses rather than setting up a program without sustainable funding.

“Obviously with rapid inflation, it’s going to show bigger revenue than we anticipated so we’ll probably … continue to pay down debt and have some one-time expenditures,” Karickhoff said.

Indiana Capital Chronicle is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Indiana Capital Chronicle maintains editorial independence. Follow Indiana Capital Chronicle on https://facebook.com/IndianaCapitalChronicle and https://twitter.com/INCapChronicle