Indiana Communities Wait Uneasily as Lawmakers Eye Food and Drink Tax Change

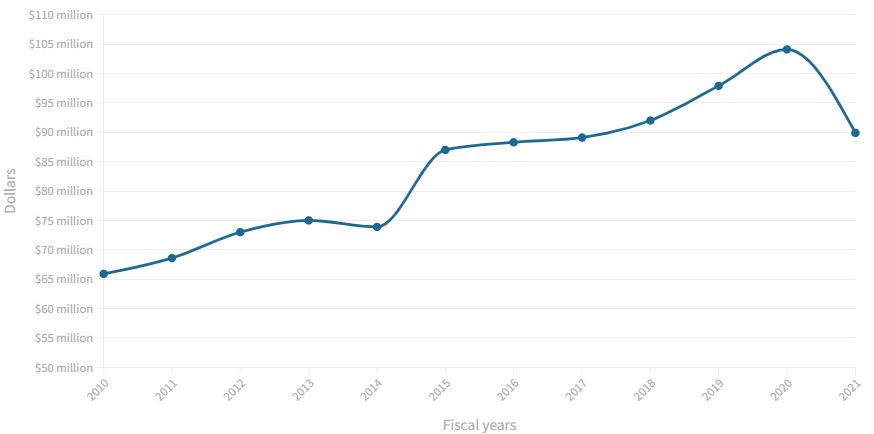

Food and beverage tax collections across the state have grown as more communities have adopted the tax. Fiscal year 2021 saw a drop due to COVID-19. Health fears and regulations led to revenue drops and even closures for many restaurants.

By Leslie Bonilla Muñiz

Language reshaping how Indiana communities participate in a food and drink tax worth roughly $90 million a year was a step away from becoming law last March, before state legislators excised it last-minute. But one of its most dedicated proponents says he’ll try again this year, prompting resistance — even resentment and defiance — from some.

“I think we need to continue the discussion that we started last year with food and beverage tax,” Sen. Travis Holdman, R-Markle, told the Capital Chronicle. “I have an interest in making sure that taxpayers are protected and that when food and beverage tax measures are taken locally, that the funds are actually used for what they say they’re going to be used for.”

Language that originated in Senate Bill 390 would’ve sunset nearly all of Indiana’s existing food and beverage taxes by 2042 — or when related project bonds are paid off — plus introduced standardized spending criteria and stringent spending reporting requirements. Sen. Gaskill, R-Pendleton, another major proponent, authored the bill; he declined an interview. Holdman was second author.

That bill’s language made its way to House Bill 1002, but was removed in conference committee — the last step in the lawmaking process — when both legislative chambers reconcile differences in the bill versions each approved.

Local elected officials and tax administrators told the Capital Chronicle they followed the legislation’s progression closely and would again, defending their communities’ use of the revenue.

“Our books are straight,” said longtime Hamilton County Councilor Brad Beaver, a Republican. “… I think the state legislature ought to look at themselves first and not worry so much about what local government does. You know, if the citizens in my county think I’m doing something shady, they’d vote me right out.”

Not a lot of dough, but useful

Thirty-three Indiana communities have a food and beverage tax: a 1% sales duty levied on businesses that sell or help sell food and drink. In some localities, both the municipality and county have one, stacking up to 2%.

In total, they earned about $90 million off the tax in calendar year 2020, a striking pandemic-induced drop from the $104 million total a year prior.

Some local units earned in the hundreds of thousands, while their more populous counterparts earned in the millions. The revenue isn’t typically a massive part of a local budget, but can be impactful, according to Accelerate Indiana Municipalities, which represents hundreds of local units across the state.

“Indiana cities and towns are heavily reliant on property tax and income tax, so any diversification in the revenue stream at the local level would be important,” AIM CEO Matthew Greller said. “… But food and beverage taxes as a whole would be just a fraction of the revenue stream in cities and towns, and likely dedicated to special projects or efforts.”

Each local unit, generally, has its own entry in Indiana Code with a set of provisions tailored to its own goals.

Many local units initiated the tax for specific projects: central Indiana governments in 2005 for Indianapolis’ Lucas Oil Stadium, Henry County in 1987 for its Indiana Basketball Hall of Fame, or Madison County in 1988 for a riverside event center that never materialized. But after paying off the original bonds, many could spend the money elsewhere, or attained changes in state law broadening spending options.

Clear as crystal

Holdman said his driving motivation behind past and potential legislation is transparency.

For proponents of change, an across-the-board sunset would start Indiana communities off with a clean slate.

New spending criteria would standardize acceptable uses of the funds from the hodgepodge of uses currently in code, which range from the very specific to the general fund. One-time and annual reporting requirements would give officials and the public access to relatively detailed and up-to-date expense information.

Asked if a particular community or project had sparked his push for reform, Holdman name-dropped one each.

“Madison County comes to mind,” Holdman said. “We passed a food and beverage tax years ago to build a convention center on the river. To date, there’s no convention center on the river, so they just use the money for something else. Taxpayers really never had an opportunity to raise the issue with locals.”

Madison County later built a detention center with the funds, as well as smaller, largely infrastructure projects.

Madison County Auditor Rick Gardner acknowledged that the convention center “didn’t come to fruition,” though he didn’t know why. But he said spending decisions are made before the public.

“I think everything is transparent and it’s out in the open,” said Gardner, a Republican.

He described how proposed projects get scored according to need, then get sent for council consideration and appropriation. Gardner also noted that Indiana audits counties annually.

More pushback

For Hamilton County’s Beaver, the prospect of reform brings a tinge of bitterness.

He recounted how, during former Gov. Mitch Daniels’ administration, “donut county” leaders were asked to contribute to the financing of Lucas Oil. Under the resulting tax, the state keeps half of the revenue generated and sent in monthly by participating local units, until the state’s collections for the year hit $1 million. The bonds are expected to be paid off by 2037.

What Hamilton County wanted in exchange — state leaders looking into the amount of income tax revenue being returned to the county — it didn’t get, Beaver said. Instead, the county hired its own accountant.

“Indianapolis needs to be a draw; a rising tide floats all boats. But we never got a thank you. Not a free seat to a football game [at Lucas Oil], not a seat at the groundbreaking ceremony.” Beaver said.

“So next time they come back [saying] ‘let’s all hold hands,’ if I’m still here, I’ll remember,” he added.

Last regular session’s proposed legislation didn’t apply to the local units whose taxes have sunset dates, including Allen, Marion and Vigo counties. But skepticism remains even among some locals there.

Allen County initially adopted its food and beverage tax to finance renovations to its War Memorial Coliseum, then extended it for a second renovation. State-level changes to the tax a decade ago expanded potential uses and created a capital improvement board to direct the funds allocated to it toward a variety of redevelopment and revitalization projects.

“Most of the leaders advancing control or limits on the food and beverage tax are just, in my view, ideologically driven,” said Tim Pape, a former capital improvement board commissioner. He previously served as a Democrat on Fort Wayne’s city council for a decade.

“They’re out of sync, I think, with the overwhelming number of citizens who are strongly supportive of the investments that the food and beverage tax money goes to, at least in Fort Wayne,” Pape added.

What’s next?

But even local government advocates acknowledge room for reform in Indiana’s handling of food and beverage taxes.

AIM’s Greller said the current system is “fragmented,” and that getting a bill through the General Assembly is “difficult.”

“It’s not going to work everywhere,” Greller said. “… But if you do have those attributes in the community, then it would make sense to me that if it’s good for one community it should be good for all.”

“If we’re talking about a uniform food and beverage tax statewide, then I think we’d certainly be open to guardrails or any other sort of measure to direct the money into certain types of projects,” he added.

It’s not clear what form another attempt would take in the legislative session that begins in January.

“We haven’t really had much discussion about it, to be honest with you, other than the fact that it’s on our radar to do something,” Holdman said.

But, something?

“Yes.”

Indiana Capital Chronicle is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Indiana Capital Chronicle maintains editorial independence. Follow Indiana Capital Chronicle on facebook.com/IndianaCapitalChronicle and twitter.com/INCapChronicle